Using Copay Cards Safely: Access Without Compromising Care

Nov, 23 2025

Nov, 23 2025

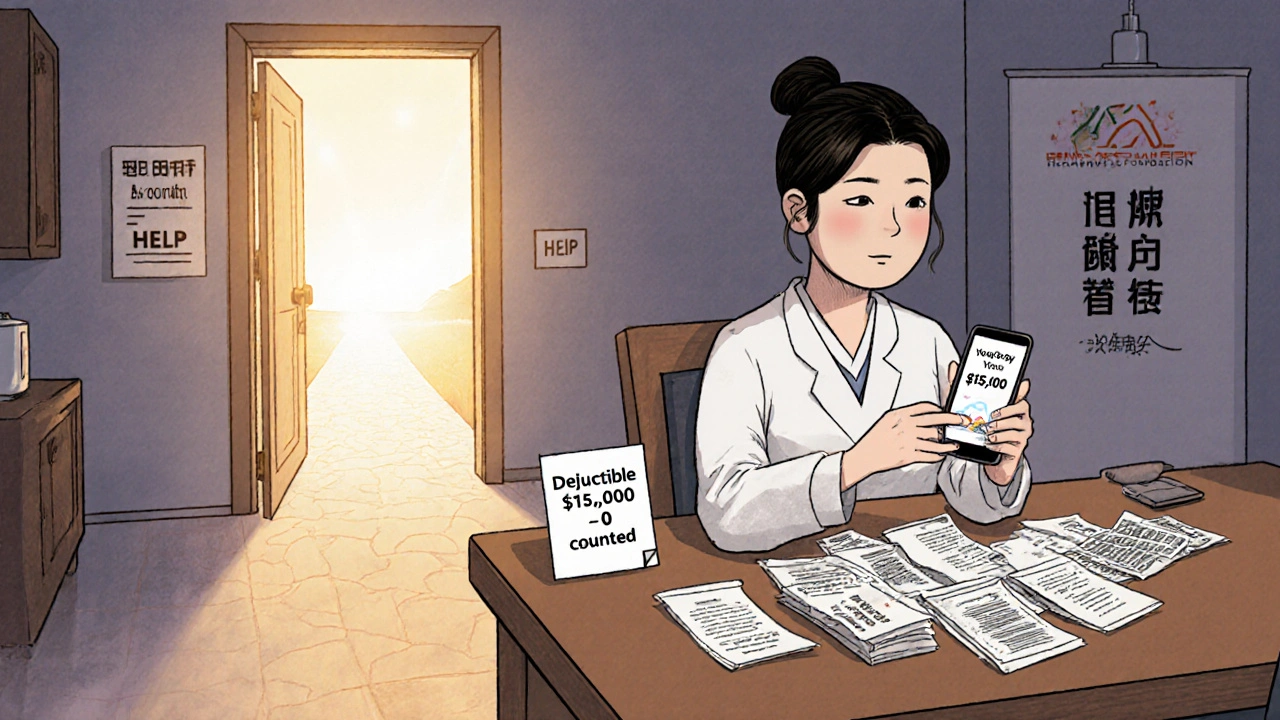

Copay Card Deductible Tracker

Understand Your Deductible Impact

Calculate how your copay card affects your deductible progress and out-of-pocket costs. Many insurance plans don't count manufacturer assistance toward your deductible.

Your Deductible Impact Report

When you’re on a specialty medication that costs thousands a month, a copay card can feel like a lifeline. For many people, it’s the only reason they can afford their insulin, rheumatoid arthritis drugs, or multiple sclerosis treatments. But here’s the catch: that lifeline might not be what it seems. What looks like savings today could turn into a financial trap tomorrow - and you might not even know it until it’s too late.

What Copay Cards Actually Do

Copay cards are offered by drug manufacturers to help commercially insured patients pay for expensive medications. If your insurance says you owe $800 for a prescription, the card might cover $700 of it, leaving you with just $100. That’s a huge win - until you realize that $700 doesn’t count toward your deductible or out-of-pocket maximum. That’s the hidden twist.

These cards were designed to improve adherence. A 2023 NIH study found 93% of patients felt the cards made a real difference in sticking with their treatment. And for good reason: some drugs cost over $100,000 a year. Without help, many would skip doses or stop entirely. But the system has changed. Since 2016, most large insurers have rolled out something called copay accumulator programs.

The Hidden Trap: Copay Accumulator Programs

Before 2016, when a manufacturer paid part of your copay, that amount counted toward your deductible. So if your deductible was $5,000 and you used a $1,000 monthly copay card, you’d hit your deductible in five months. After that, your insurance covered 100%.

Now? That’s gone. With accumulator programs, the manufacturer’s payment doesn’t count. Your $1,000 monthly card still gets you down to $100 out of pocket - but your deductible stays at $5,000. You’re still paying $100 a month, but now you’re paying it all out of your own pocket, with nothing moving you closer to coverage. By the time your card runs out, you’re suddenly responsible for the full $5,000 - and you’ve already spent $12,000 on medication that year.

According to KFF (2023), 56% of commercial insurance plans now use accumulator programs. That’s up from just 8% in 2018. The problem hits hardest with chronic conditions. One patient on the National MS Society forum shared: “My $7,500 monthly drug was $10 after two years. Then the card expired - and my deductible was still untouched. I had to stop treatment for three months.”

What’s Worse? Copay Maximizer Programs

Some insurers don’t just block the card from counting - they use it to your disadvantage. These are called copay maximizer programs. They set your copay to exactly match the maximum amount the card will cover. So if your card can pay up to $1,000, your pharmacy charges you $1,000 - even if your drug only costs $1,200. You pay $1,000. The card covers $1,000. You pay $0. Sounds great, right?

Wrong. You didn’t pay anything, so nothing counts toward your deductible. You’re stuck paying $0 now, but when the card runs out, you’re suddenly hit with the full $1,200 - and your deductible hasn’t moved. Optum Business Insights (2024) found these programs increase total drug spending for insurers by nearly 19% compared to accumulators, which is why they’re used selectively. But for patients, the outcome is the same: delayed coverage, unexpected bills, and risk of treatment interruption.

Who Gets Left Out?

Copay cards are only available to people with commercial insurance. Medicare and Medicaid patients can’t use them - federal law bans it. That means people on government plans, even if they’re struggling to pay, get no help from these programs. Meanwhile, employers with self-insured plans - which make up 67% of large employer coverage - are the most likely to use accumulator programs. If you get insurance through your job, you’re statistically more likely to be caught in this trap.

The American Medical Association called this out in 2022, passing a resolution opposing accumulator programs. Their data showed a 23.4% higher rate of treatment discontinuation among patients affected. That’s not just a financial issue - it’s a health crisis. One patient with lupus told a Reddit thread: “I was fine for two years. Then the card ran out. I couldn’t afford the drug. My kidneys started failing. I had to go to the ER.”

How to Use Copay Cards Safely

You don’t have to be blindsided. There are steps you can take - right now - to protect yourself.

- Ask your pharmacist: “Does my insurance plan have a copay accumulator or maximizer program?” Don’t assume. Don’t wait. Ask every time you refill.

- Check your deductible progress: Call your insurer or log into your portal. Ask: “How much of my deductible have I met this year? Has any of my manufacturer assistance counted toward it?”

- Know your card’s limits: How much is left? When does it expire? Most cards last 12 months, but some reset annually. Keep track.

- Plan ahead: If your card expires in six months and you’re still far from your deductible, talk to your doctor about alternatives. Is there a generic? A different drug? A patient assistance program through the manufacturer that doesn’t rely on insurance?

Specialty pharmacies now use “accumulator alerts.” When 80% of your card value is used, they send you a warning - giving you 60 days to adjust. Ask if your pharmacy offers this. If they don’t, demand it.

What’s Changing in 2025 and Beyond

The tide is turning - slowly. In September 2024, the Department of Health and Human Services proposed a new rule: insurers must clearly disclose accumulator programs during enrollment and send monthly statements showing your true deductible progress. That rule takes effect January 1, 2026. It won’t fix everything, but it will force transparency.

CVS Caremark has started rolling out “transparency dashboards” that show patients exactly how much they’ve paid and how much counts toward their deductible - even with accumulators. But right now, that’s only available to 28% of commercially insured Americans.

Meanwhile, Congress is considering the Copay Accumulator Moratorium Act, which would ban these programs for three years. It has 72 bipartisan sponsors. But drugmakers spent nearly $29 million lobbying against it in early 2024. The fight isn’t over.

What You Can Do Today

If you’re using a copay card:

- Don’t assume your payments are helping you reach your deductible.

- Don’t wait until the card runs out to find out.

- Don’t let fear of cost stop you from asking questions.

Every patient deserves access to care - not just access to a card that disappears when they need it most. The system is broken. But you’re not powerless. The more people ask, the harder it becomes for insurers to hide the truth.

Ask your pharmacist. Call your insurer. Talk to your doctor. Write down the answers. Keep them. Share them. You’re not just protecting your wallet - you’re protecting your health.

Can I use a copay card if I’m on Medicare or Medicaid?

No. Federal law prohibits pharmaceutical companies from offering copay assistance to patients enrolled in Medicare or Medicaid. This is due to anti-kickback statutes designed to prevent fraud. Patients on these programs should instead look into manufacturer patient assistance programs (PAPs), which are separate and often provide free or low-cost medications based on income.

How do I know if my insurance has a copay accumulator program?

Ask your pharmacy or insurer directly. You can also check your insurance documents - look for terms like “copay accumulator,” “copay maximizer,” or “manufacturer assistance does not count toward deductible.” If you’re unsure, call the customer service number on your card and ask: “Does my plan redirect manufacturer copay assistance away from my deductible?”

What should I do if my copay card runs out and I still haven’t met my deductible?

Contact your drug manufacturer immediately. Many companies offer extended assistance programs or patient support services that kick in after the card expires. You can also ask your doctor about alternative medications, generic options, or financial aid programs through nonprofit organizations like the Patient Access Network Foundation or the HealthWell Foundation.

Are copay cards worth it if my plan has an accumulator program?

Yes - but only if you understand the trade-off. If you’re on short-term treatment or your card lasts longer than it takes to meet your deductible, you’ll still save money. But if you need long-term care and your card expires before you reach your out-of-pocket maximum, you’ll face a huge financial shock. Use the card, but plan for what comes after.

Can my pharmacist help me navigate copay cards and accumulator programs?

Absolutely. Specialty pharmacists are trained to identify accumulator programs and can help you understand your coverage. Many now use automated alerts to warn patients when their card is about to expire. Ask if your pharmacy offers this service. If they don’t, request it - your safety depends on it.

David Cunningham

November 25, 2025 AT 09:10Man I never realized how sneaky these copay cards could be. I’ve been using one for my MS med for two years and just assumed the manufacturer payments were helping me hit my deductible. Turns out I’m basically paying $12k a year and getting zero credit for it. Wild.

Jessica Correa

November 26, 2025 AT 04:30so like... if your card runs out and your deductible is still at 0 you're basically back to square one? that feels so cruel

luke young

November 26, 2025 AT 14:20Yeah Jessica I know right? I had a friend who had to stop her lupus meds for three months because of this. She ended up in the ER. It’s not just about money - it’s about survival.

Robin Johnson

November 28, 2025 AT 08:38Don’t wait until your card expires to figure this out. Talk to your pharmacist now. Ask if they have accumulator alerts. If they don’t, switch pharmacies. Your life depends on knowing this stuff before it’s too late.

Mark Williams

November 30, 2025 AT 08:36From a payer analytics standpoint, copay maximizers are a rational cost-shifting mechanism - they preserve margin for PBMs while maintaining adherence metrics. But ethically, it’s a structural failure in benefit design. The incentive alignment is perverse: insurers profit from prolonged high-cost utilization while patients bear the clinical risk.

Latonya Elarms-Radford

November 30, 2025 AT 10:36Oh sweet merciful heavens, this is what happens when capitalism meets healthcare - a grotesque ballet of corporate greed disguised as ‘benefits.’ We’ve turned life-saving medication into a financial obstacle course where the finish line moves every time you get close. And the worst part? The people who designed this system will never have to pay a dime out of pocket. They’re sipping champagne while you’re choosing between insulin and rent.

james lucas

December 1, 2025 AT 14:07i had no idea this was even a thing till i read this. my mom uses a copay card for her rheumatoid arthritis med and i just thought she was lucky. now im terrified. shes gonna get wrecked when it runs out. gotta call her insurance right now

New Yorkers

December 2, 2025 AT 21:52Let me get this straight - you’re telling me the very thing meant to help you survive is secretly sabotaging your future access to care? This isn’t healthcare. This is a psychological warfare tactic disguised as insurance. And the worst part? They call it ‘innovation.’

manish chaturvedi

December 2, 2025 AT 23:27As someone from India where even basic medicines are out of reach for many, this system feels like a luxury trap. Here, we dream of having any insurance at all. But in the U.S., even with insurance, you’re still being played. The irony is brutal. I hope more people wake up to this.

Daniel Jean-Baptiste

December 3, 2025 AT 21:42just had a chat with my pharmacy and they said they do have the accumulator alert system but its opt in. i had no clue. just signed up. if your pharmacy doesnt offer it ask for it. its not hard to implement and its lifesaving

Rahul Kanakarajan

December 4, 2025 AT 04:59why are people even surprised by this? pharma companies are profit machines. of course theyll design systems to keep you hooked on their drugs while letting insurers take the financial hit. this is capitalism 101. stop acting like it’s a conspiracy.