Bridging Studies for NTI Generics: Ensuring Safety and Efficacy in Generic Drug Approval

Dec, 25 2025

Dec, 25 2025

When a drug has a narrow therapeutic index (NTI), even a small change in dose can mean the difference between healing and harm. Drugs like warfarin, phenytoin, digoxin, and levothyroxine fall into this category. They’re lifesavers-but only if the dose is just right. That’s why getting a generic version of an NTI drug right isn’t just about saving money. It’s about saving lives.

Why NTI Generics Need Special Treatment

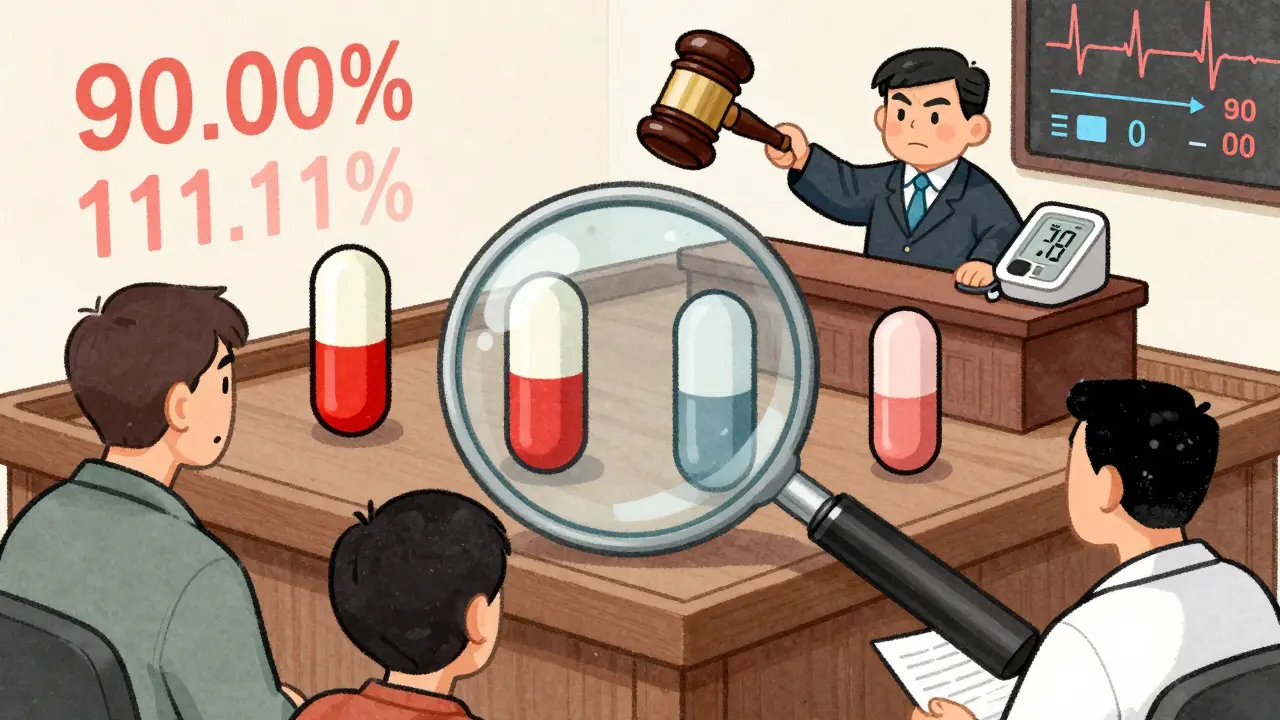

Most generic drugs are approved using standard bioequivalence studies. These compare how quickly and how much of the drug enters the bloodstream between the brand-name version and the generic. The acceptable range? Between 80% and 125% for key measures like Cmax and AUC. For most drugs, that’s enough. But for NTI drugs, that range is too wide. A 20% difference in blood levels might push a patient into toxicity-or leave them underdosed and at risk of seizure, clotting, or thyroid crisis. That’s why regulators require tighter standards. The U.S. FDA and the European Medicines Agency (EMA) both agree: NTI generics need more than just a standard bioequivalence study. They need a bridging study-a more precise, more rigorous test designed to prove the generic behaves the same way in the body, down to the smallest detail.What Makes a Bridging Study Different?

A typical NTI bridging study uses a 4-way crossover design. That means each participant takes four different versions of the drug over time: the brand-name drug twice, and two different batches of the generic. This isn’t just a longer study-it’s a smarter one. By comparing the same person across multiple doses, researchers can account for natural differences in how individuals absorb and process drugs. The acceptance criteria are also tighter. Instead of 80-125%, the 90% confidence interval for Cmax and AUC must fall between 90.00% and 111.11%. That’s a much narrower window. Even more, the quality control for the generic drug’s active ingredient must be within 95-105%, not the 90-110% allowed for non-NTI generics. These aren’t arbitrary numbers. They come from years of clinical data showing that even small variations in blood levels of drugs like warfarin can lead to major outcomes-like dangerous bleeding or stroke. The FDA’s 2017 guidance on warfarin sodium tablets set the gold standard, and since then, other NTI drugs have followed the same pattern.Which Drugs Are Classified as NTI?

The FDA doesn’t just guess which drugs are high-risk. They use five clear criteria to classify them:- The difference between the minimum effective dose and the minimum toxic dose is no more than 2-fold.

- The range of drug concentrations that work therapeutically is also no more than 2-fold.

- The drug requires regular blood testing to monitor levels.

- Within-subject variability is low to moderate-under 30%.

- Doses are often adjusted in small increments, usually less than 20%.

- Warfarin-the prototype for NTI drug development. A few milligrams off can cause life-threatening bleeding.

- Phenytoin-used for seizures. Too much causes dizziness and nausea; too little can trigger a seizure.

- Digoxin-for heart failure. Levels above 2 ng/mL can be toxic.

- Levothyroxine-for hypothyroidism. Even a 12.5 mcg difference can affect heart rate and energy levels.

Why Are NTI Generics So Hard to Develop?

Developing an NTI generic isn’t just harder-it’s more expensive, more time-consuming, and more risky. A standard bioequivalence study might cost $1.5-2.5 million. For NTI drugs, it jumps to $2.5-3.5 million. Why? Because of the 4-way crossover design. It requires twice as many participants, takes 12-18 months to complete (compared to 6-9 months), and demands specialized statistical analysis. Only about 35% of generic manufacturers have the in-house expertise to run these studies. Many have to partner with contract research organizations that specialize in pharmacokinetic modeling and reference-scaled average bioequivalence (RSABE) methods. Even then, the learning curve is steep. Companies typically need 18-24 months to build the right team and processes. And the rejection rate? It’s high. Between 2018 and 2022, 37% of complete response letters for NTI generics cited inadequate bridging study design as the main reason for rejection. For non-NTI generics, that number was only 12%.Market Reality: Fewer Generics, Higher Costs

Despite the need, NTI generics have struggled to gain market share. While 85% of non-NTI drugs have generic versions, only 42% of NTI drugs do. That’s a $32.8 billion opportunity left untapped. Why? Because manufacturers see the cost and complexity as too high. And when they do enter the market, payers and prescribers often remain hesitant. Many doctors still prefer the brand-name version, fearing subtle differences in how the generic performs. The FDA has tried to help. Their pre-ANDA meeting program lets companies talk to regulators early in development. About 82% of applicants say these meetings cut time and cost. But the process remains slow. Only 18 NTI generics were approved between 2018 and 2022, compared to over 1,000 non-NTI generics.

What’s Changing? New Tools and Global Harmonization

There’s hope on the horizon. In March 2023, the FDA expanded its list of NTI drugs requiring special bioequivalence studies from 12 to 27. That means more clarity for manufacturers. The European Medicines Agency is working with the FDA and the International Council for Harmonisation (ICH) to align global standards. A new ICH E18 guideline, expected in 2025, will address how ethnic differences affect NTI drug response-a key issue for global supply chains. And then there’s technology. Physiologically-based pharmacokinetic (PBPK) modeling is being tested as a possible alternative to full clinical studies. In a 2022 pilot study, PBPK models accurately predicted the behavior of warfarin generics without needing large-scale human trials. While promising, the FDA still says: “For the foreseeable future, robust clinical data will remain essential.”What This Means for Patients and Prescribers

You might wonder: if generics are cheaper, why aren’t we using them more for NTI drugs? The answer is trust. Patients on warfarin, for example, often have their INR levels checked every few weeks. If they switch to a generic and their INR suddenly changes, it’s not just inconvenient-it’s dangerous. That’s why many clinicians stick with the brand. But here’s the flip side: if a generic is properly approved under NTI bridging standards, it’s just as safe. The data proves it. The problem isn’t the science-it’s the perception. The key is better communication. Pharmacists and doctors need clear guidance on which generics are truly equivalent. Prescribers should be reassured that FDA-approved NTI generics meet the same high bar as the brand. And patients? They deserve access to affordable, reliable options. The system isn’t perfect-but it’s getting better. With tighter standards, clearer labeling, and smarter tools, we’re moving toward a future where NTI generics are no longer the exception.What’s Next?

The future of NTI generics depends on three things:- Regulatory clarity-more drugs added to the NTI list, consistent global standards.

- Manufacturer investment-companies willing to spend the time and money to do it right.

- Provider and patient education-building confidence that a properly approved generic is not a compromise.

What is a narrow therapeutic index (NTI) drug?

A narrow therapeutic index (NTI) drug is one where the difference between the effective dose and the toxic dose is very small. Even a slight change in blood levels can lead to treatment failure or serious side effects. Examples include warfarin, phenytoin, digoxin, and levothyroxine. These drugs often require regular blood monitoring to ensure safe use.

Why do NTI generics need bridging studies?

Standard bioequivalence studies use a wide range (80-125%) to prove generics are similar. But for NTI drugs, that range is too loose. Bridging studies use tighter criteria (90-111.11%) and more complex designs-like 4-way crossover trials-to ensure the generic behaves almost identically to the brand in the body. This prevents dangerous fluctuations in drug levels.

How are NTI bridging studies different from regular bioequivalence studies?

Regular bioequivalence studies are usually 2-way crossover trials with 20-30 participants. NTI bridging studies are 4-way crossover trials with 40-60 participants, lasting 12-18 months. They require advanced statistical methods like reference-scaled average bioequivalence (RSABE) and tighter acceptance criteria for drug absorption (90-111.11% vs. 80-125%). The cost is also 30-50% higher.

Are all generic versions of NTI drugs safe?

Only those approved under the FDA’s or EMA’s specific NTI bridging guidelines are considered safe. Not all NTI generics on the market have undergone these rigorous studies. Patients and prescribers should check if the generic has been formally designated as an NTI product under regulatory guidance. Generic drugs without proper bridging data may pose risks.

Why are so few NTI generics available?

Developing an NTI generic is expensive, complex, and time-consuming. It costs $2.5-3.5 million and takes 3-5 years-compared to $1.5-2.5 million and 2-3 years for standard generics. Many manufacturers avoid the risk, especially since only 42% of NTI drugs have generics, compared to 85% for non-NTI drugs. Regulatory hurdles and low market incentives make it a tough business case.

Can PBPK modeling replace bridging studies for NTI generics?

PBPK (physiologically-based pharmacokinetic) modeling shows promise and has been tested successfully in pilot studies, especially for warfarin. It uses computer simulations to predict how a drug behaves in the body. But regulators still require clinical data for approval. While PBPK may reduce the need for large human trials in the future, it’s not yet accepted as a full replacement for bridging studies.

Michael Bond

December 26, 2025 AT 04:37NTI generics are the silent heroes of affordable medicine. Most people don’t realize how much science goes into making sure a $5 pill doesn’t kill someone.

It’s not just about cost-it’s about precision.

Kuldipsinh Rathod

December 27, 2025 AT 21:45in india we got generic warfarin everywhere but no one checks INR anymore. scary stuff. i’ve seen patients switch and end up in ER. not because the drug’s bad-but because no one’s trained to monitor it right.

we need better education, not just better science.

SHAKTI BHARDWAJ

December 29, 2025 AT 20:47OMG WHY DO WE EVEN BOTHER??

THE FDA IS JUST A BIG CORPORATE TOY BOX!!

THEY LET BIG PHARMA CONTROL EVERYTHING!!

THEY DON’T CARE ABOUT PATIENTS!!

THEY JUST WANT MORE MONEY AND MORE POWER!!

AND NOW THEY WANT US TO TRUST THESE ‘BRIDGING STUDIES’ LIKE THEY’RE MAGIC??

WHEN I WAS A KID WE JUST TOOK THE PILL AND PRAYED!!

WHY DID WE HAVE TO MAKE IT SO COMPLICATED??

THEY’RE JUST HIDING BEHIND ‘STATISTICS’ TO SELL MORE DRUGS!!

AND DON’T EVEN GET ME STARTED ON ‘PBPK’-THAT’S JUST A COMPUTER GAME!!

THEY’RE LYING TO US!!

IT’S ALL A SCAM!!

AND I’M NOT ALONE!!

Matthew Ingersoll

December 30, 2025 AT 18:46The regulatory framework for NTI generics is among the most rigorously designed in modern pharmacology. The 90-111.11% CI isn’t arbitrary-it’s rooted in decades of clinical outcomes data.

What’s remarkable is how little public awareness exists about this, despite the life-or-death stakes.

Transparency in labeling and prescriber education are the next logical steps.

carissa projo

December 31, 2025 AT 14:35There’s something deeply human about this whole issue.

We’re not just talking about blood levels and confidence intervals-we’re talking about people who wake up every morning wondering if today’s pill will keep them alive.

It’s not just about science-it’s about trust.

And trust doesn’t come from a label or a regulatory stamp.

It comes from consistency, from communication, from doctors who take the time to explain.

When a patient has been stable on brand-name warfarin for ten years, switching to a generic-even one approved under perfect conditions-feels like stepping off a cliff.

That fear isn’t irrational.

It’s real.

And until we acknowledge that emotion as part of the equation, no amount of data will move the needle.

Maybe the real bridge isn’t in the study design-it’s in the conversation between clinician and patient.

We need to stop treating this like a math problem and start treating it like a relationship.

Bryan Woods

December 31, 2025 AT 22:30It’s worth noting that the 37% rejection rate for NTI generics due to inadequate bridging studies is significantly higher than the 12% for standard generics. This reflects the technical difficulty and precision required, not regulatory overreach.

Manufacturers must invest in specialized PK/PD modeling expertise and high-quality manufacturing controls.

There’s no shortcut here.

Ryan Cheng

January 1, 2026 AT 01:17Biggest myth: ‘All generics are the same.’

Not even close.

NTI drugs? They’re like a high-end watch-every gear has to turn perfectly.

Standard generics? More like a reliable bicycle.

One’s got a 20% tolerance. The other’s got a 2% tolerance.

And yeah, that’s why it costs more.

But if you’re on digoxin, you don’t want a bicycle.

You want the watch.

Shreyash Gupta

January 2, 2026 AT 03:48everyone says ‘trust the science’ but where’s the science that says the generic is better than brand?

there isn’t any.

brand name has 50 years of data.

generic has 6 months of lab numbers.

so why are we pretending they’re equal?

also why do we let big pharma control the NTI list?

maybe they added drugs to the list to kill competition.

just saying.

🤔

Ellie Stretshberry

January 3, 2026 AT 20:09i just switched my levothyroxine to generic and felt tired for a week

my doctor said it’s fine

but i still wonder

why do they make it so hard to know if it’s really the same

like can’t they just put a sticker on the bottle

like ‘this one passed the extra test’

that’s all i want

just a little sign

so i don’t have to stress

and my doctor doesn’t have to guess

it’s not that hard

right

Zina Constantin

January 5, 2026 AT 01:30This is the kind of innovation that deserves applause.

Not every industry has the courage to say: ‘We won’t cut corners, even if it costs more.’

NTI generics are proof that science can be both precise and compassionate.

Let’s stop treating them like second-class drugs.

They’re not cheaper alternatives.

They’re carefully engineered miracles.

And the people who make them? They’re the quiet guardians of patient safety.

Dan Alatepe

January 5, 2026 AT 19:28in nigeria we don’t even have access to branded NTI drugs most times

so when a generic shows up

we take it

and pray

no one checks levels

no one knows what bridging means

we just want the pill

and if it keeps us alive

then it’s good enough

maybe the real problem isn’t the science

it’s the fact that some of us don’t even get to play the game

Angela Spagnolo

January 6, 2026 AT 15:26...i just read this whole thing...and i’m...i don’t know...overwhelmed?

it’s so much...and i didn’t even understand half of it...

but i know someone i love is on warfarin...

and i just want them to be safe...

so...thank you...for writing this...

even if i didn’t get all the numbers...

i got the heart of it...

please...keep doing this...

Sarah Holmes

January 7, 2026 AT 02:08Let us not be deceived. The FDA’s so-called ‘tighter standards’ are nothing more than performative compliance designed to appease public concern while enabling corporate profit margins to remain intact.

The 90-111.11% interval is still a 21.11% margin of error-far too vast for a drug where a single milligram can induce cardiac arrest.

And the notion that PBPK modeling is merely ‘not yet accepted’ is a lie propagated by regulatory capture.

They have the technology to eliminate human trials entirely.

They choose not to.

Because they profit from the illusion of control.

And patients? We are the collateral damage in their bureaucratic theater.