Negotiated Rebates on Generics: What Insurance Actually Pays

Feb, 7 2026

Feb, 7 2026

When you fill a prescription for a generic drug like metformin or lisinopril, it’s easy to assume your insurance paid a low price because the drug itself costs pennies. But here’s the truth: what insurance actually pays for generics isn’t what you see on your receipt - and it’s rarely what the pharmacy gets paid. The system is built on layers of hidden fees, opaque contracts, and financial incentives that often work against lower-cost drugs.

Generics Don’t Get Rebates Like Brand Drugs Do

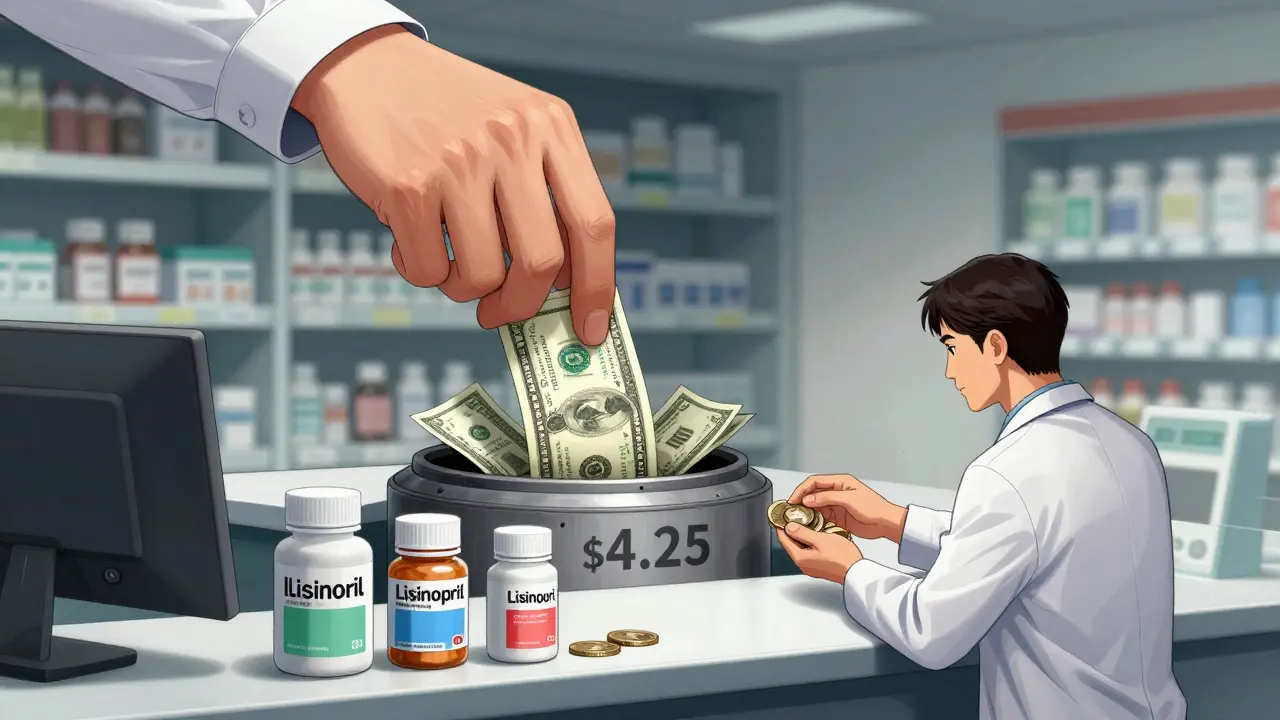

Most people think rebates are how drug prices get lowered. That’s true for brand-name drugs. Manufacturers of drugs like Humira or Ozempic offer big rebates - sometimes 30% to 70% off the list price - to pharmacy benefit managers (PBMs) in exchange for being placed on a health plan’s preferred list. PBMs then pass part of that rebate back to insurers, making it look like the plan saved money. But generics? They don’t play by those rules. Because dozens of companies can make the same generic drug - say, atorvastatin - there’s no monopoly. No single manufacturer controls the market. So instead of offering rebates, they compete on price. The result? List prices for generics are already low. A 100-tablet bottle of generic lisinopril might cost $4 at the pharmacy. That’s it. No rebate needed. That’s where things get strange.What Insurance Actually Pays: The Spread Pricing Trap

Here’s how it works in practice. Your insurance plan thinks it’s paying $8.50 for that $4 generic. But the pharmacy only gets $4.25. The $4.25 difference? That’s kept by the PBM. This is called spread pricing. It’s not a rebate. It’s not a discount. It’s a hidden profit. PBMs - the middlemen between insurers, pharmacies, and drugmakers - negotiate contracts that let them charge insurers more than they pay pharmacies. And they don’t have to tell anyone. In 2022, the U.S. Department of Health and Human Services found the average spread on generic prescriptions was $4.73. That means for every generic drug filled, the PBM pocketed nearly $5 without the insurer or patient ever knowing. For a large employer with 10,000 employees, that’s over $1 million a year in hidden costs - all from drugs that were supposed to save money.Why This System Exists

PBMs make money in two ways: through rebates on brand drugs and through spread pricing on generics. But here’s the twist: they’re often paid more for pushing brand-name drugs. If a brand-name drug offers a 60% rebate, and a generic offers zero, the PBM has a financial reason to keep the brand on the formulary - even if the generic is cheaper. In 2023, Rightway Healthcare found PBMs sometimes excluded low-cost generics just to protect relationships with brand manufacturers. One employer discovered their PBM blocked a $0.15-per-dose generic in favor of a $5 brand with a 60% rebate. The net cost? Higher. It’s backwards. The drug that saves the most money gets sidelined because it doesn’t generate a rebate.

Who Pays the Real Price?

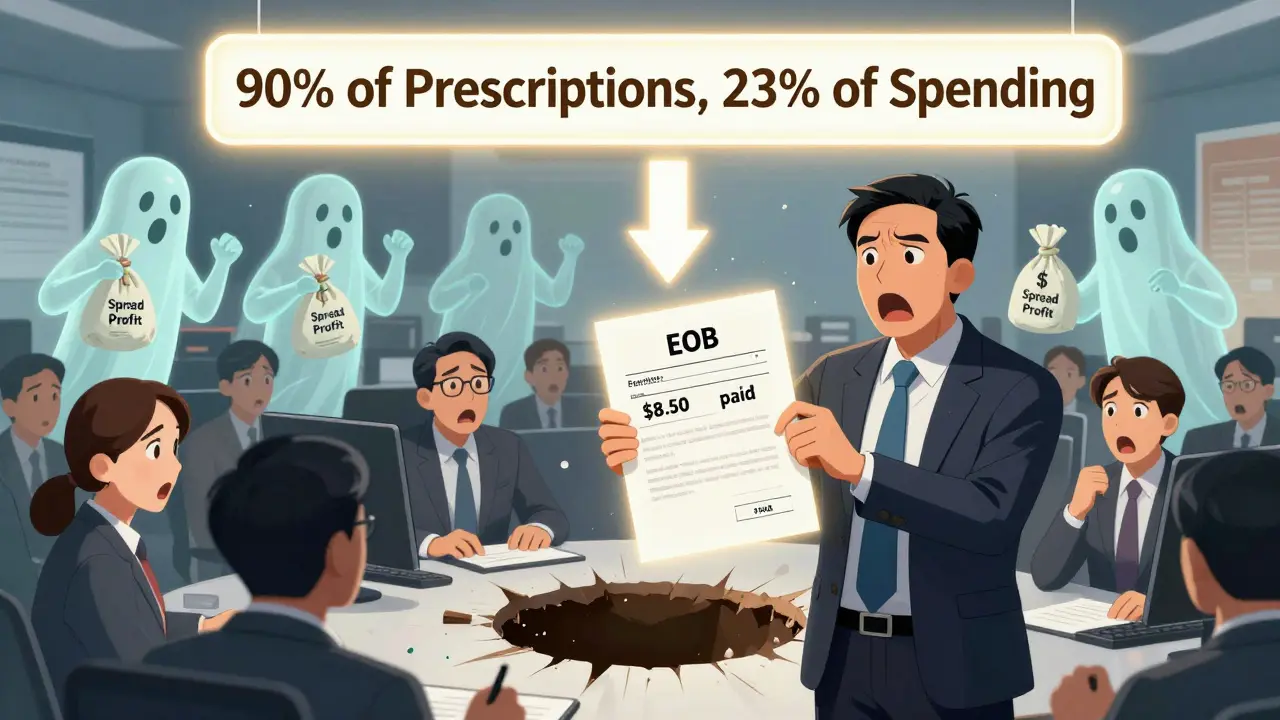

You might think insurers are the ones absorbing these hidden costs. But they’re not. Most large employers are self-insured. That means they pay for claims directly, not through a traditional insurance company. The PBM collects fees and spreads, but the employer is left footing the bill. A 2023 survey by the National Business Group on Health found 68% of large employers couldn’t figure out what they were actually paying for generic drugs. One HR director from a Fortune 500 company said, “We found out our PBM charged us $8.50 per generic, paid the pharmacy $4.25, and kept the rest. We had no idea.” Patients pay too. Even if your copay is $3, you’re still paying for the PBM’s spread. And if your plan has a deductible, that $4.73 difference gets added to your out-of-pocket costs.The Bigger Picture: 90% of Prescriptions, 23% of Spending

Generics make up 90% of all prescriptions filled in the U.S. But they account for only 23% of total drug spending. That’s the power of low prices - if the system worked as intended. Instead, spread pricing and lack of transparency are eating away at those savings. The Congressional Budget Office estimates eliminating spread pricing on generics could save employer-sponsored plans $5 to $7 billion annually by 2027. Meanwhile, the Inflation Reduction Act of 2022 explicitly excluded generics from Medicare’s new drug price negotiation program. Why? Because the government recognized that generics are already priced by competition - not by rebates. But that doesn’t stop PBMs from gaming the system behind the scenes.

What’s Changing?

There’s growing pressure to fix this. In 2024, 42% of large employers switched to pass-through pricing - where PBMs charge a flat administrative fee and pass along the actual cost of the drug. No spreads. No secrets. The Department of Labor and CMS have started requiring more transparency. The Biden administration’s 2024 executive order directed HHS to examine practices that limit generic use. And by 2026, experts predict new rules will force PBMs to disclose exactly what they pay pharmacies for generics. Some insurers are already acting. A growing number of health plans now require PBMs to pass through 100% of generic drug savings. Others are switching to PBM contracts that cap fees or ban spread pricing entirely.What You Can Do

If you’re an employee or employer:- Ask your benefits provider: “Do we use spread pricing on generics?”

- Request a breakdown of what your plan pays per generic drug.

- Look for PBMs that use pass-through pricing - they’re becoming more common.

- Check your explanation of benefits (EOB). If the “amount paid by plan” is higher than the pharmacy’s cash price, you’re likely paying a spread.

- Use tools like GoodRx or SingleCare to compare cash prices - sometimes they’re cheaper than your insurance copay.

- Ask your pharmacist: “Is this the lowest price I can get?”

- Don’t assume your insurance always gets the best deal.

The Bottom Line

Insurance doesn’t pay rebates on generics. It pays spreads. The system was designed to save money - but instead, it’s become a hidden tax on the cheapest drugs we have. Generics are meant to be the solution. But when the middlemen profit from keeping them expensive, the whole system fails. The truth? What insurance actually pays for generics isn’t what you think. And until that changes, you’re still paying more than you should.Do generic drugs have rebates like brand-name drugs?

No, generic drugs typically don’t have rebates. Brand-name drugs use rebates - often 30% to 70% of the list price - to get placed on insurance formularies. But because multiple manufacturers produce generics, they compete on price instead. Their prices are already low, so rebates aren’t needed. PBMs make money on generics through spread pricing, not rebates.

Why does my insurance seem to pay more for a generic than the pharmacy gets paid?

That’s called spread pricing. Your PBM charges your insurer (or employer) one price - say $8.50 - but only pays the pharmacy $4.25. The $4.25 difference is kept by the PBM as profit. This is hidden from patients and often from employers too. It’s not a rebate; it’s a markup.

Can PBMs block generic drugs to favor brand-name ones?

Yes. If a brand-name drug offers a 60% rebate and a generic offers zero, the PBM can make more money by keeping the brand on the formulary. In some cases, PBMs have excluded cheaper generics to protect relationships with brand manufacturers - even when the net cost to the plan was higher. This is a known issue documented by the Commonwealth Fund and Rightway Healthcare.

Why aren’t generics included in Medicare’s drug price negotiation program?

The Inflation Reduction Act of 2022 excluded generics because they’re already priced by competition. With dozens of manufacturers making the same drug, prices stay low naturally. The law only allows negotiation for single-source brand drugs and biologics with no generic alternatives. This recognition of market competition is why generics are left out - but PBM practices still distort their true cost.

How can I find out if my plan is using spread pricing?

Ask your employer or insurer: “Do you use pass-through pricing for generics?” If they say no, they’re likely using spread pricing. You can also check your Explanation of Benefits (EOB) - if the “plan paid” amount is significantly higher than the cash price on GoodRx or SingleCare, you’re probably paying a spread. Some employers now publish PBM contract details - look for terms like “net cost,” “acquisition cost,” or “dispensing fee.”

Sarah B

February 7, 2026 AT 16:10Patrick Jarillon

February 9, 2026 AT 03:14Mary Carroll Allen

February 10, 2026 AT 07:30Jesse Lord

February 10, 2026 AT 13:50Niel Amstrong Stein

February 11, 2026 AT 13:10Tola Adedipe

February 13, 2026 AT 08:28Amit Jain

February 14, 2026 AT 16:27Ashley Hutchins

February 15, 2026 AT 07:38Gouris Patnaik

February 16, 2026 AT 23:24Lakisha Sarbah

February 17, 2026 AT 01:22Paula Sa

February 19, 2026 AT 00:22Ariel Edmisten

February 19, 2026 AT 20:17Marcus Jackson

February 20, 2026 AT 06:19Joey Gianvincenzi

February 21, 2026 AT 22:19Ariel Edmisten

February 22, 2026 AT 17:55